Buying property in Haryana? Hold on, you need to know about stamp duty! It’s that extra cost you probably didn’t consider. In Haryana, just like in the rest of India, stamp duty plays a significant role in property transactions. Forget about it, and you’re in for a last-minute surprise. So what exactly is this stamp duty in Haryana on property?

Think of it as the government’s cut for legalising your property ownership. You pay it, you get a stamp —your property is legally yours. Don’t worry; this blog will dive deep into the ins and outs of stamp duty in Haryana to give you a clear understanding.

Stamp Duty in Haryana on Property | 2023 Rates

Property registration stamp duty rates vary in Haryana based on the type of document, the area, as well as the gender. Follow the table below related to stamp duty in Haryana on property.

| Deed Type | Rural Area | Urban Area |

| Trust Deed | Rs. 45 | Rs. 45 |

| Gift Deed | 3% | 5% |

| Sale or Conveyance Deed | 5% | 7% |

| Exchange Deed | 6% of either market or property value | 8% of either market or property value |

| General Power of Attorney | Rs. 300 | Rs. 300 |

| Special Power of Attorney | Rs. 100 | Rs. 100 |

| Loan Agreement | Rs. 100 | Rs. 100 |

Stamp Duty for Ladies in Haryana | Rates

As part of its efforts to encourage women to become homebuyers in Haryana, the government has reduced stamp duty rates for them. The following table shows the stamp duty for ladies in Haryana depending on the type of ownership:

| Ownership Type | Rural Stamp Duty | Urban Stamp Duty |

| Female | 3% | 5% |

| Male | 5% | 7% |

| Co-ownership | 4% | 6% |

Calculating the Stamp Duty on Property in Haryana

Here is how to calculate property stamp duty rates in Haryana.

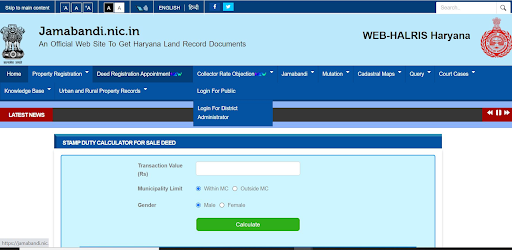

- Navigate to the Jamabandi.nic.in portal. Tap on Property Registration from the menu bar.

- In the dropdown menu, choose the option ‘Stamp Duty Calculator’.

- On the next page, you must enter certain details like the transactional value, municipality limit & gender. For a detailed estimate of stamp duty, click ‘Calculate’.

Stamp Duty on Property in Haryana Calculation Tips

Calculating stamp duty in Haryana for property registration or even the property tax in Haryana? You’ll need to factor in several aspects. The rate you’ll pay depends on a few variables: the owner’s gender, the location of the property, its type, and any special amenities it might have. For example, the state government offers exemption of stamp duty on transfer of property in Haryana to female owners, aiming to boost home ownership among women.

Additionally, if you’re buying a property in an urban area or investing in residential projects in Kurukshetra or other such areas, expect to pay higher stamp duty compared to a rural location, which mirrors the elevated property values in cities. Various property types, like residential, commercial, or industrial, also come with their own set of stamp duty rates.

Moreover, luxury features in your property could trigger extra stamp duty charges. Don’t forget that exemption of stamp duty on transfer of property in Haryana can sometimes apply, depending on your situation.

Paying Stamp Duty and Registration Fees in Haryana

Online Method

- Start by going to the official website of the National Government Service Portal.

- Choose the Haryana e-Stamping option and enter the details of the first party, who is the payer, along with the property address.

- Fill in the names of both the first and the second parties involved in the transaction.

- Pick the stamp paper category and the amount you need from the list provided.

- Review the form carefully and finalise your payment.

Offline Method

- You can also opt for the traditional route by buying stamp papers valued at more than Rs. 10,000.

- Head to the treasury office to purchase these papers.

- Deposit the amount under the code ‘0030-Stamp and Registration’ at a State Bank of India branch.

Choose the method that suits you best to make this necessary payment for property registration in Haryana hassle-free.

What are the Penalties in Delays with Payments?

Missed your deadline for stamp duty in Haryana for property registration? According to Section 23 of the Registration Act 1908, you’ve got four months from when the deed is executed to submit all necessary documents.

Fall behind and you could face a penalty: up to 10% of your registration charges could be added to your bill. Keep this in mind as property stamp duty rates in Haryana aren’t cheap, and delays can result in extra expenses that could have been avoided. Stay on schedule to avoid these unnecessary financial headaches.

Last Thoughts

In summary, understanding Stamp Duty in Haryana on Property is crucial for a seamless real estate experience. From the varying rates based on location and property type to exemptions and penalties, it’s a complex subject that demands thorough research and understanding. After all, nobody wants surprise charges or legal hiccups down the line.

If you’re feeling overwhelmed by all these variables, consider seeking professional guidance. For reliable assistance, especially if you’re looking for a trusted builder in Haryana, we highly recommend DAA Home Realtors.

Our expertise in the property market can help you navigate stamp duty and other regulatory challenges, ensuring a hassle-free property acquisition. Trust our experts to guide you home.