Do you own property in Haryana? Therefore, it is important for someone to know about property taxes in order not to face unanticipated costs later on. In this regard, the state, including Haryana, imposes a property tax on all real estate properties. Generally, different types of properties, their sizes, places where they are located, etc. are taken into consideration in determining the tax rate.

When it comes to Haryana, it is essential to remain abreast of changes occurring concerning taxation levels as well as other relevant property tax rules in Haryana. Here, we will discuss all that there is to know about property tax in Haryana, including what types of taxes are collected, exemptions, etc. Let’s get started!

Property Tax Types

There are six essential types that you can remember when talking about property tax in Karnal Haryana or any other area. Taxation relates to any person who owns or inhabits a residential establishment. This applies also to the category of commercial, industrial, as well as institutional assets. These include property taxes on government-owned buildings too. Lastly, vacant land can also be assessed.

It is critical to have an understanding of your responsibilities & what constitutes legal and rightful rates for each form of property. Be it you buy property in Kurukshetra or any nearby areas, it will be helpful in fulfilling your duties & keeping finances at their top.

Eligibility Criteria

It’s vital to keep in mind that this tax is mandatory for anyone who meets the following eligibility criteria:

1. You are above 18 years old.

2. You are a permanent resident of Haryana.

3. You own a property in Haryana.

To avoid any kind of penalty & legal issues, make sure to pay your property tax on time. Be informed about the latest property tax rules in Haryana & follow the guidelines set by the government.

Property Tax Rate in Haryana

The tax slabs for the property tax rate in Haryana regarding residential properties, commercial properties, and vacant land in Haryana are as follows:

Residential Properties

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 300 square yard | Rs. 1 per square yard |

| From 301 to 500 square yard | Rs. 4 per square yard |

| From 501 to 1000 square yard | Rs. 6 per square yard |

| From 1001 sq. yard to 2 acres | Rs. 7 per square yard |

| More than 2 acres | Rs. 10 per square yard |

Vacant Land

| Plot size | Rate (in Rs. per square yard) |

| Up to 500 square yard | Exempted |

| 101 and above | Rs. 5 per square yard |

| 501 and above | Rs. 2 per square yard |

Commercial Spaces

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 1000 square yard | Rs.12 per square yard |

| Up to 1,000 square yard | Rs.15 per square yard |

Commercial Property (Ground Floor Shops)

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 50 square yard | Rs. 24 per square yard |

| From 51 to 100 square yard | Rs. 36 per square yard |

| From 101 to 500 square yards | Rs. 48 per square yard |

Using the above slabs, you can get all the answers to how to calculate property tax in Haryana.

Property Tax Exemption in Haryana

Let us take a closer look at the property tax exemption in Haryana for property owners:

1. Clear Your Dues and Get a One Time Rebate

If you clear all your property tax dues or arrears within forty-five days from the notification of rates, you can receive a one-time rebate of 30% of the tax amount. This is a great incentive for property owners to stay on top of their taxes and clear their dues in a timely manner.

2. Pay Your Total Tax Before 31st July and Get Rebate

If you pay your total tax for the assessment year by the 31st of July of that particular year, you can receive a rebate of 10% on the tax amount. This is another great way to save money on your property taxes and stay on top of your financial responsibilities.

3. Religious Properties are Exempt from Property Tax

Religious properties like temples, gurudwaras, mosques, and churches are exempted from property tax in Haryana. This exemption applies to all buildings and lands attached to the religious property and can be a great relief for those who own such properties.

4. State Government Buildings are Eligible for Rebates

State government buildings are eligible for a 50% rebate on their property taxes. However, there are some exceptions to this rule, such as the construction of boards, corporations, undertakings, and autonomous bodies.

How to Pay Property Tax Online in Haryana?

Here is how to pay property tax online in Haryana. Follow the steps below.

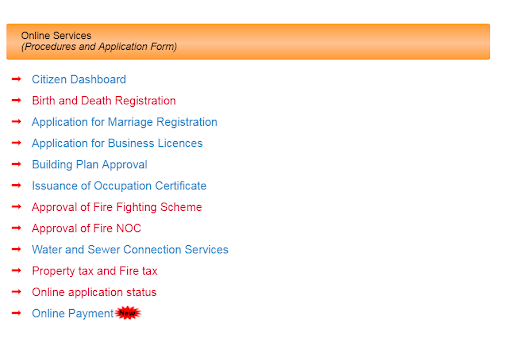

- Go to the official website of Haryana’s Directorate of Urban Local Bodies.

- Tap on the “Property tax” option.

- Provide the relevant details asked (refer to the image below).

- Now you can see the property tax generated for each property.

- Tap on “Pay property tax” & pay your tax online.

- The payment gateway will process your payment.

All in all, this is all about online property tax in Haryana.

Last Say

The information provided in this post demonstrates the online property tax in Haryana. It highlights the importance of being aware of region-specific policies when considering investing in real estate. Hence, the investors in this regard need to follow closely the taxation rules as revised by the government.

In addition, a buyer should seek out a local real estate advisor, who would be able to draft the right documents and recommendations necessary when facing the native taxation setting of the property. For all of you out there trying to find someone who would be trustworthy enough to be your property developer in Haryana. Seek assistance from DAA Home Realtors, which are professional estate agents.

In fact, by virtue of our knowledgeable view of specific operational characteristics of this market; we stand in a good position to provide valuable support to any client at different points in their purchasing decisions. If you would like to not only know about your own tax responsibilities but also look through all ways leading to a successful purchase and/or sale of residential property in this state, we encourage you to employ our services.